When Bad Actors Get Creative, Your SARs Must Get Sharper

By: High Risk Education & Auriemma Roundtables & FinCrim Solutions, LLC

SAR writing rarely gets headlines, but it’s one of the most important lines of defense in the fraud fight. As fraud becomes more creative, more coordinated, and more scalable, the quality of your SARs matters more than ever. A strong SAR helps law enforcement connect dots across institutions. A weak one leaves those dots floating in space.

And lately, criminals have been getting very creative.

Criminals Adapt. Your SARs Can’t Stand Still.

The days of simple “one-off” fraud are long gone. Today’s cases involve synthetic identities, multi-channel movement, mule accounts, and schemes that hit several FIs at once. Fraudsters test systems, automate steps, and mimic normal customer behavior better than ever.

With schemes becoming more complex, SAR narratives have to do more than recap transactions. They need to explain what’s unusual, why it matters, and what type of fraud it points toward.

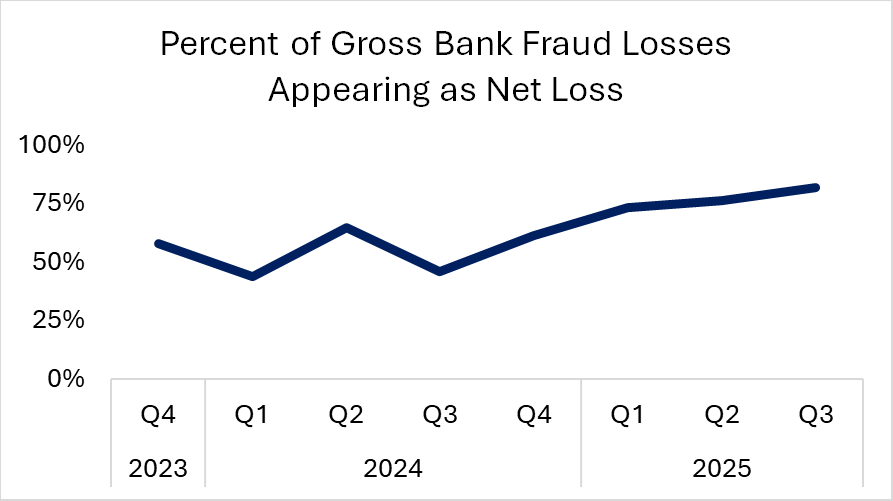

Fraud Losses Are Getting Harder to Recover

Auriemma data shows that a growing share of gross bank fraud losses are ultimately being realized as net losses. Since late 2023, the percentage of fraud dollars that institutions fail to recover has trended steadily upward, reaching more than three- quarters of total losses by mid-2025. This shift reflects faster fund movement, more effective laundering, and fewer recovery opportunities once fraud is detected, raising the stakes for early identification and clear SAR narratives.

What Makes a Sharper SAR

A sharper SAR is built around clarity and purpose. Good narratives answer the questions every investigator has in mind: Why is this activity suspicious? What risk does it represent?

Strong SARs consistently:

Provide context. A $20,000 wire isn’t suspicious on its own; it’s suspicious if the customer has never wired more than $800 in the past year.

Show connections. If activity ties to other accounts, prior reports, or known fraud patterns, the SAR should say so clearly.

Identify the likely scheme. Even a simple hypothesis like synthetic ID, ATO, mule activity, elder scam gives law enforcement direction they need.

Stay plain and specific. No jargon, no filler. Just the story of what happened, why it’s abnormal, and why it matters.

Where SAR Writing Meets Fraud Trends

Modern fraud is layered. Synthetic identities build clean histories before exploding in activity. Mules use multiple accounts, devices, and channels. Cross-channel fraud starts with digital access and ends with card or ACH movement.

If your SAR only covers what happened inside “your” product or team, the bigger picture may never make it into the system.

SARs should reflect this shift. When bad actors connect the dots, institutions have to connect them too.

Common SAR Weaknesses We See Too Often

Even experienced teams fall into predictable traps when SAR volumes rise and fraud schemes grow more complex. Some of the most common weaknesses don’t involve missed transactions, they involve missed explanations.

One frequent issue is a copy-paste narrative that describes activity without interpreting it. Transactions are listed accurately, but the SAR narrative never answers the most important question: why this activity is suspicious for this particular customer. Without that explanation, the narrative becomes a timeline, not intelligence.

Another common gap is missing the context of a customer’s expected activity. SARs often fail to anchor activity to a customer’s historical baseline. Law enforcement doesn’t know whether a transaction is routine or extraordinary unless the SAR explains it. A sudden spike in wires, new payees, or rapid movement across channels matters far more when framed against what “normal” looked like before. Saying that transactions are “unusual” or “inconsistent with expected activity” is not enough. Strong SARs explain how behavior changed, when it changed, and why that change aligns with known fraud or money laundering typologies.

These weaknesses don’t reflect a lack of effort, they reflect the reality of limited resources, stringent reporting requirements and increased alert volumes. But as schemes grow more sophisticated, narratives that stop short of interpretation risk losing their value once they leave the institution.

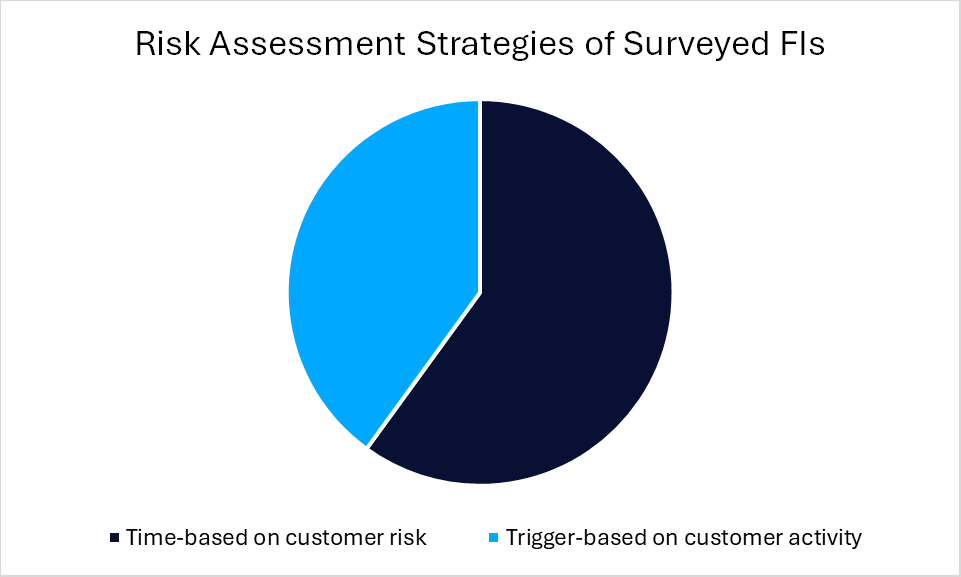

How Institutions Assess Risk Is Still Split

Survey data shows that most financial institutions still rely on time-based risk assessments tied to customer risk ratings, while a sizable minority use trigger-based reviews driven by customer activity. This split matters. Time-based approaches can miss fast-moving, coordinated schemes, while trigger-based strategies are better positioned to capture sudden behavior shifts that often define modern fraud. For SAR writers, this reinforces the need to clearly articulate why activity stands out now, not just how it compares to a periodic review cycle.

Small and mid-size banks can be at a disadvantage compared to larger financial institutions. Auriemma Roundtables closes that gap by providing real, operational data on fraud trends, loss drivers, and control breakdowns that are typically only visible inside the largest banks. Through peer benchmarking and shared intelligence, members can see how schemes are evolving, where defenses are failing, and how others are responding in real time. It levels the playing field, so strong judgment is backed by hard data, and SARs reflect not just what happened, but what it means in today’s fraud environment.

Regulatory and Examiner Expectations Are Changing

Regulators and examiners continue to focus on timely and accurate SAR filings, but there is growing emphasis on clear reasoning and risk understanding, not just transaction reporting. During exams and lookbacks, SAR narratives are often reviewed as evidence of how well an institution understands the activity occurring within its walls. A SAR that clearly explains why activity is suspicious, even if conclusions are preliminary, signals a thoughtful, risk-based approach. A vague or boilerplate narrative can raise more questions than it answers. Identifying a specific scheme, such as synthetic identity, account takeover, mule activity, etc., demonstrates strong analytical skills and helps to support the rationales behind investigative decisions.

Clear, thoughtful narratives also matter defensively. When institutions can show how they identified unusual behavior and documented their reasoning, they are better positioned during exams and lookbacks. In today’s environment, SARs are not just filings, they are records of institutional judgment.

The Bottom Line

Bad actors are getting smarter. They’re creative, coordinated, and constantly refining their playbooks. The only way to keep pace is with SARs that actually tell the story, not just the sequence of events, but the meaning behind them.

A SAR is more than a box to check. It’s a message to law enforcement, to regulators, and to your own organization: We understand what’s happening, and we’re paying attention.

Make your SARs sharp enough to match the creativity of the criminals behind them.

More on Auriemma Roundtables’ data offerings, and sample metrics.