BRINGING FRAUD IN-HOUSE

FINANCIAL FRAUD CONSORTIUM NEWSLETTER

August 2025

Bringing fraud detection and prevention in-house for a bank, Program Manager, or Fintech is a strategic move that can enhance security while ensuring a more tailored approach to fraud management. Careful consideration should be given to what you should insource vs. what you’d like to remain outsourced. Be careful not to move too quickly and plan to have to continuously improve post in-sourcing to get the most value out of your plans.

Below are some high-level first steps to consider when transitioning fraud operations in-house:

- Assessing Current Capabilities

Evaluate Existing Systems: Conduct an assessment of current fraud detection and prevention systems, tools, and procedures. Identify which aspects are being outsourced and understand their effectiveness.

Talk to Key Departments: Quick chats can arm you with information that may not arise during normal conversation. Make a list of the key departments that you believe will be crucial in your fraud prevention fight. Don’t forget to ensure you get feedback from the Business Lines, Customer Service, Operations, Legal and Compliance.

Perform a Gap Analysis: Determine any gaps in capabilities, technologies, and expertise that need to be addressed to facilitate the transition.

- Define Objectives and Scope

Set Clear Goals: Define what you want to achieve by bringing fraud operations in-house, such as reduced response times, increased control over processes, or improved customer experience.

Establish Scope: Outline which areas of fraud management will be brought in-house (e.g., transaction monitoring, chargeback management, customer education) and set clear boundaries on expectations.

- Build a Dedicated Team

Identify your staffing needs: Determine organizational structure needed and how many staff members will be needed initially based on assumptions and if possible staffing models.

Hire Skilled Professionals: Recruit staff with expertise in fraud detection, risk management, data analytics, and compliance. This may include fraud analysts, data scientists, IT security personnel, and customer service representatives.

Training and Development: Invest in training programs not only for the newly hired team but also for existing staff to ensure they understand fraud dynamics within the digital banking landscape.

- Select Appropriate Technologies

Invest in Fraud Detection Tools: Evaluate and implement fraud detection and prevention technologies that align with your needs. This could include machine learning algorithms, behavioral analytics, and case management systems. Ensure each and every channel is covered in either real-time or near-real time fashion.

Integration with Existing Systems: Ensure that new tools integrate smoothly with your existing banking systems, such as customer relationship management (CRM) and core banking platforms.

- Develop Policies and Procedures

Create Clear Policies: Develop clear policies and procedures for fraud detection, investigation, and resolution. These should outline protocols for action in case of suspicious activity and escalation processes.

Document Workflow Process: Establish documented workflow processes to guide how incidents are handled to ensure consistency, transparency, and adherence to the established policies.

- Implement Monitoring and Reporting Frameworks

Real-Time Monitoring: Set up systems for real-time monitoring of transactions and customer behavior to identify and assess potentially fraudulent activities promptly.

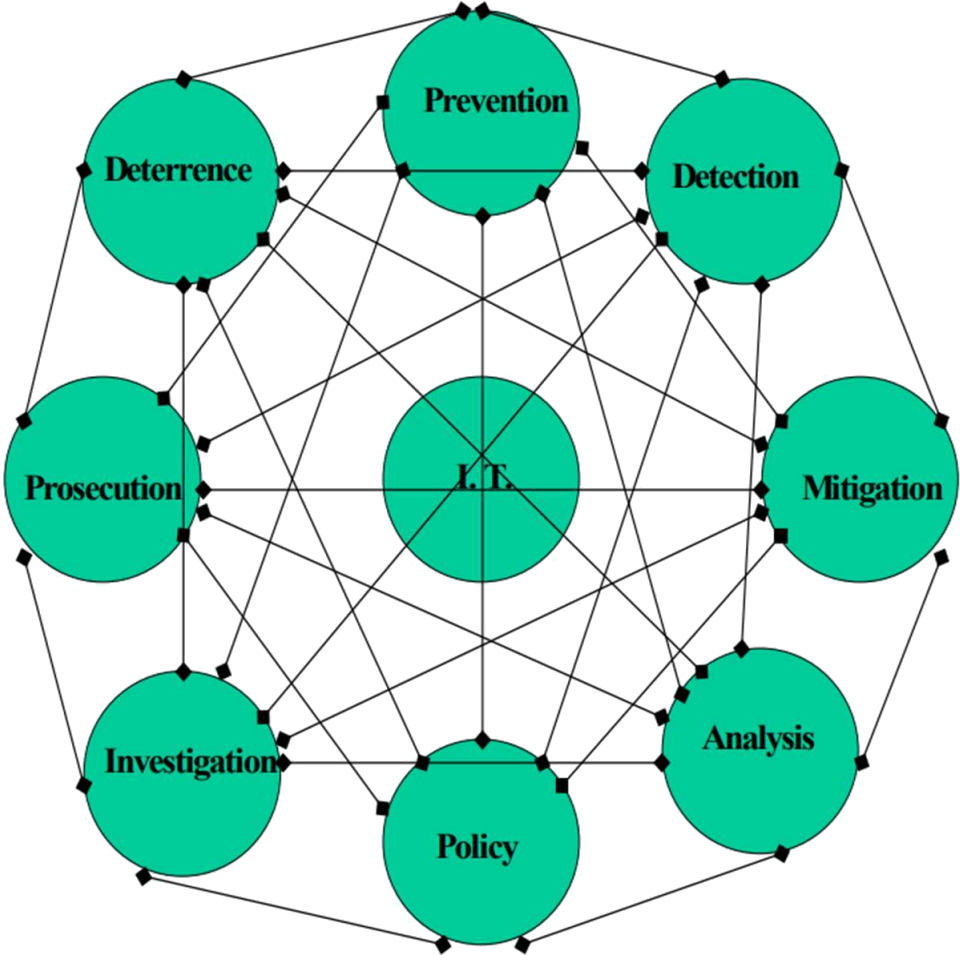

Follow the Fraud Management Lifecyle to ensure you have each of the elements covered for each channel you will be supporting:

Journal of Economic Crime Management Spring 2004, Volume 2, Issue 2

Reporting Mechanisms: Develop reporting tools that allow for regular review of fraud trends, detection success rates, and incident resolution effectiveness, enabling continuous improvement.

- Ensure Compliance and Regulatory Adherence

Understand Regulatory Requirements: Familiarize yourself with the legal and regulatory landscape regarding fraud management, anti-money laundering (AML), and data protection.

Compliance Audits: Establish a framework for regular compliance audits to ensure adherence to regulations and internal policies.

- Engage Consortiums, Customers and Stakeholders

Educate Customers: Develop educational materials to help customers recognize potential fraud risks and understand how your bank protects them.

Share Information with Stakeholders: Regularly communicate updates and findings from fraud management initiatives to stakeholders, including executive leadership and relevant departments.

Know your Key Performance Indicators and your Key Risk Indicators: Understanding your Key Performance Indicators (KPIs) in tandem with your Key Risk Indicators (KRIs) is paramount in measuring the effectiveness of your fraud prevention efforts. By establishing clear metrics, organizations can assess their operational performance and risk exposure in real time, aligning strategic objectives with actionable insights.

Join a Consortium: Collaborating with industry peers not only enhances data sharing but also fortifies collective intelligence, providing a multi-faceted defense against fraud schemes that continuously adapt to exploit vulnerabilities.

- Test and Iterate

Pilot Programs: Consider starting with a pilot program in specific areas of fraud management before fully transitioning. Assess effectiveness and make necessary adjustments based on feedback and results.

Iterative Improvements: You will not get it 100% correct right out of the gate. Plan to develop continuous process to collect data and feedback after bringing fraud operations in-house and iterate on your processes, technologies, and personnel training to stay ahead of emerging threats.

- Create a Culture of Fraud Awareness

Promote a Fraud-Prevention Culture: Foster a culture within the organization that prioritizes fraud awareness, encouraging all employees to be vigilant and proactive in identifying potential issues.

Bringing fraud operations in-house can offer numerous advantages, including greater control, faster response

times, and a more personalized approach to fraud prevention. By following these initial steps, a bank, Program

Manager or Fintech can create a solid foundation for effective fraud management while continuously adapting to

an evolving threat landscape. Regular review and adaptation of strategies will be essential for success in this

endeavor.

Financial Fraud Consortium

info@financialfraudconsortium.org